property tax assessor las vegas nv

Or Company Name Last Name Required. Disabled Veterans Exemption which provides for veterans who have a permanent service-connected disability of at least 60.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Grand Central Pkwy Las Vegas NV 89155 702 455-0000 Copyright 2021 Clark County NV Login.

. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook. Henderson NV 89015 702-267-2323. 111-11-111-111 Address Search Street Number Must be Entered.

Tenaya Way 118 Las. Show present and prior owners of the parcel. Please enter all information known and click the SUBMIT button.

The surviving spouse of a disabled. Contact your local Assessor for details. Household goods and personal effects.

The Assessor parcel maps are for assessment use only and do NOT represent a survey. The Assessor is required by law to assess all real property at current value which is represented by the replacement cost of the improvement less depreciation and market value of the land. Check here for phonetic name match.

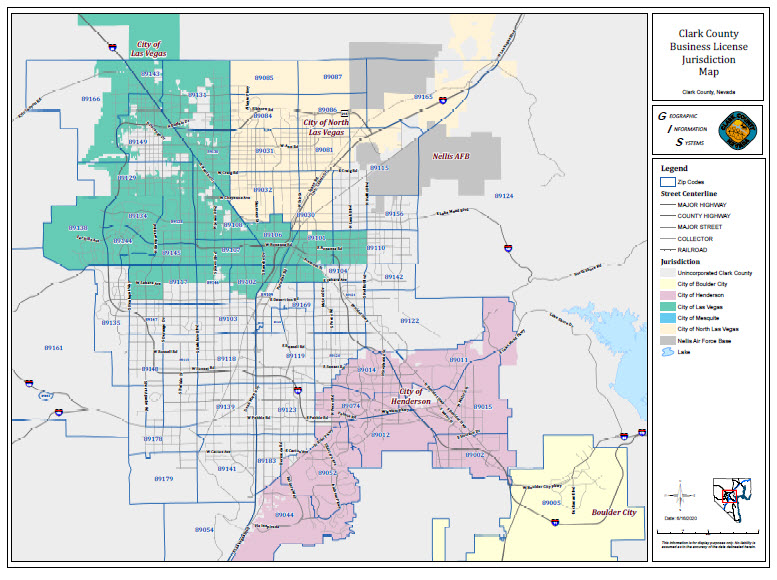

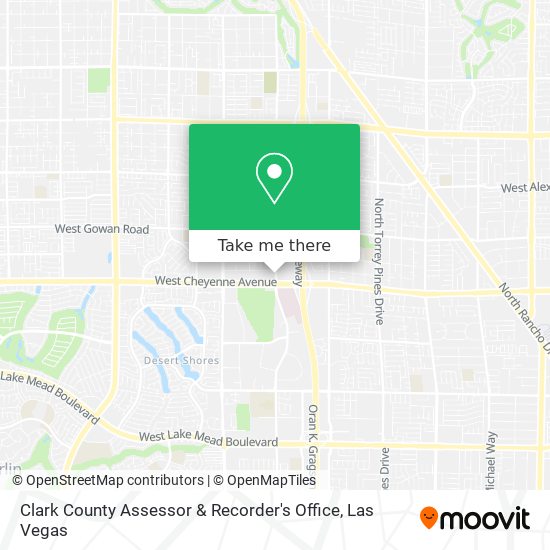

In Clark County property taxes are collected by the Treasurers Office and distributed to the. Clark County Assessor Clark County Government Center 500 South Grand Central Parkway Las Vegas NV 89155 Phone 702455-3882. Parcel inquiry - search by Owners Name.

View sales history tax history home value estimates and overhead views. Property Account Inquiry - Search Screen. Occasionally some Assessor files are.

To qualify the Veteran must have an honorable separation from the service and be a resident of Nevada. 3 beds 3 baths 1396 sq. The tax is levied by the governing authority of the jurisdiction in which the property is located.

CALCULATING LAS VEGAS PROPERTY TAXES. Show current parcel number record. 730am - 530pm Fri.

In Washington State all real and personal property is subject to tax unless specifically exempted by law eg. NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Grand Central Pkwy Las Vegas NV 89155 702 455-0000 Copyright 2021 Clark County NV Login.

Name Clark County Assessors Office Address 500 South Grand Central Parkway Las Vegas Nevada 89155 Phone 702-455-3882. Boulder City Bunkerville Enterprise Glendale Henderson Indian Springs Las Vegas Laughlin Mesquite Moapa Moapa Valley Mt. Homeowners insurance 26.

AOCustomerServiceRequestsClarkCountyNVgov 500 S Grand Central Pkwy Las Vegas Nevada 89155 Operating Hours Mon. The Assessor is required by Nevada law to assess all property every year. The Assessor parcel maps are compiled from official records including surveys and deeds but only contain the information required for assessment.

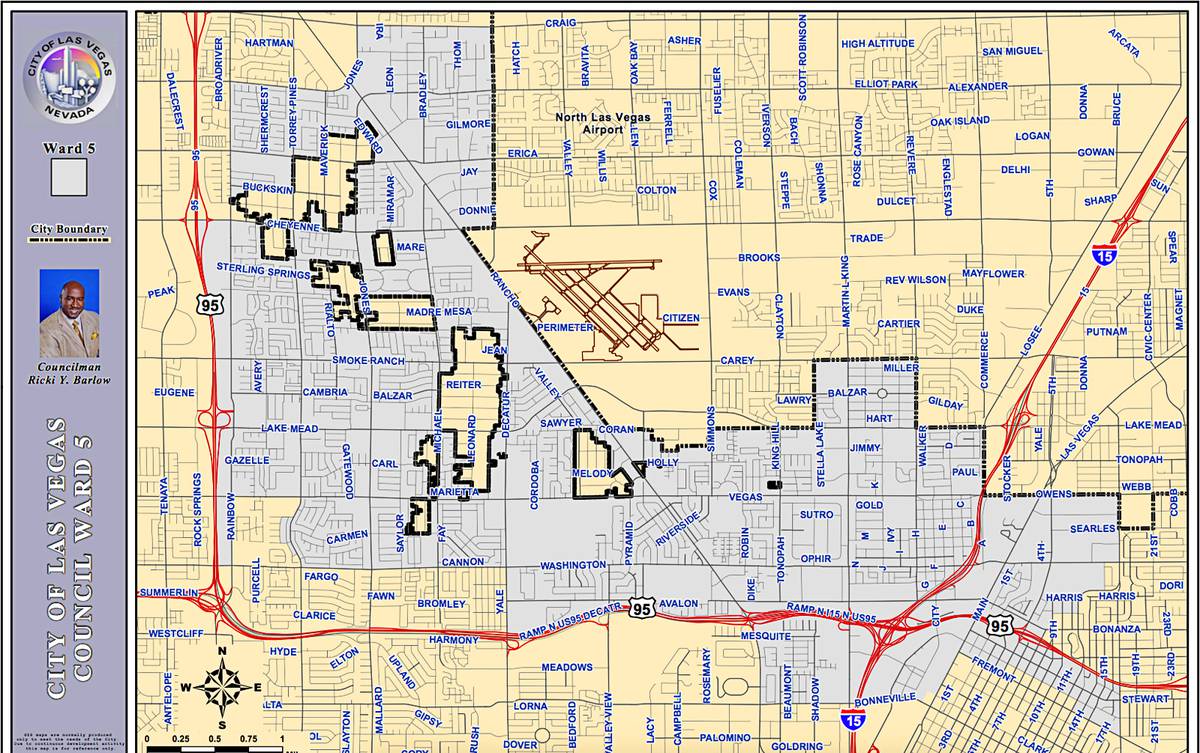

With our guide you will learn important information about North Las Vegas property taxes and get a better understanding of what to expect when you have to pay. If street number is entered results will include addresses within three 3 blocks. Ad Stop Procrastinating - Get Matched To Top Rated Local Appraisers Today.

Public Property Records provide information on land homes and commercial properties in Las Vegas including titles property deeds mortgages property tax assessment records and other documents. Nevada Administrative Code requires the Nevada Assessors to use Marshall Swift Building Cost. If you are contemplating becoming a resident or just planning to invest in the citys property youll come to understand whether the citys property tax statutes are favorable.

House located at 4529 Metpark Dr Las Vegas NV 89110 sold for 99000 on Apr 30 1996. 730am - 530pm Tue. Nevada county assessor offices grant tax relief to DMV customers.

Las Vegas NV 89155 Grand Central Map Website. To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value of 200000 located in the as Vegas with a tax rate of 350 per hundred dollars of assessed value. 123 Main St City State and Zip entry fields are optional.

Certain rural assessors also offer vehicle registration services. 730am - 530pm Wed. Henderson City Hall 240 S.

See reviews photos directions phone numbers and more for Property Tax Assessor locations in Las Vegas NV. Property Tax Rates for Nevada Local Governments Redbook. To determine the assessed value multiply the taxable value of the home 200000 by the.

Address and Phone Number for Clark County Assessors Office an Assessor Office at South Grand Central Parkway Las Vegas NV. The amount of exemption is dependent upon the degree of disability incurred. Exemptions may be used to reduce vehicle Governmental Services Taxes or property taxes.

Let Us Help You Find The Best Pro For the Best Price Every Time. Several government offices in Las Vegas and Nevada state maintain Property Records which are a valuable tool for understanding the history of a property finding property. Charleston North Las Vegas Paradise Searchlight Spring Valley Summerlin.

730am - 530pm Thur. Account Search Dashes Must be Entered. See the recorded documents for more detailed legal information.

Las Vegas Plan To Annex Small Portions Of Clark County Fuels A Flare Up Las Vegas Sun News

Clark County Seeks Residents Input On Short Term Rental Survey

Taxpayer Information Henderson Nv

Inman Connect Las Vegas 2021 Attom

Logic Launches New Property Tax Appeal Division Logic Commercial Real Estate

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

How To Get To Clark County Assessor Recorder S Office In Las Vegas By Bus

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Las Vegas Area Clark County Nevada Property Tax Information

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Smith Wollensky Las Vegas The Saucy Culinarian Las Vegas Vegas Baby Vegas

How To Protect Real Property From Fraud Las Vegas Probate Attorney Near Me

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty